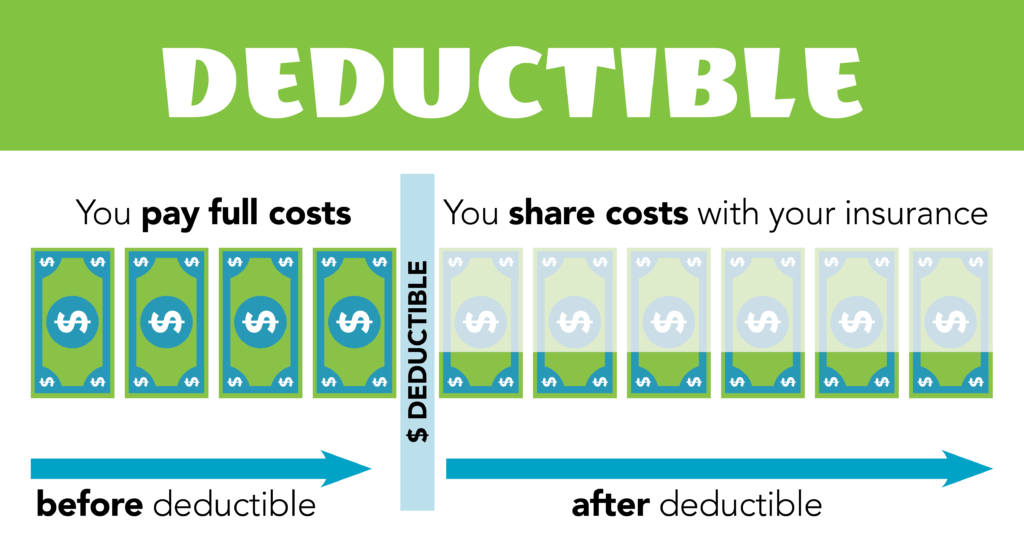

On the other hand, replacement-cost policies will reimburse you at the items' current retail price, without considering depreciation. Change your coverage quantity based on which option you pick. In addition to your insurance coverage company and your place, your insurance coverage amount will greatly affect your premiums, so choose a coverage amount that results in affordable premiums. It's a great concept to keep sufficient cash in your emergency fund to cover at least the insurance coverage deductiblethe amount you need to pay before your insurance supplier starts to spend for covered losses. Some insurance provider put a limitation on the quantity that they will cover in various areas.

If this holds true, then you would require to buy an additional policy to cover those products. Likewise, you may require an extra policy to cover your liability in relation to your job. As soon as you determine how much renter's insurance coverage you must get, shop around for renter's insurance plan to get the most affordable yearly premium. Visit the website of (or make a phone call to) an insurance coverage business to get a quote, and after that get a tenant's insurance policy. Some business offer discount rates that can further minimize your premium. These discount rates often vary by state. For example, you may get a discount rate if you get your occupant's insurance coverage through the very same insurance business where you get your automobile insurance.

Similar to with vehicle insurance, you can conserve money by shopping for a brand-new policy every couple of years. To submit a claim with your insurer, have your policy number and be all set to share the type of property claim and the involved loss. Then, call your agent. The representative will explain what is covered and might schedule an assessment of the residential or commercial property to assess the loss and estimate the cost to cover it. Do not try to clean up a product or a location till the representative has actually looked at your home. Also, record the damage or other loss with photos.

Tenants insurance coverage rates are super budget friendly, under $30 a month for the most part. That's an anticipate the security you get. Renters insurance coverage is a policy developed to help secure you financially if you lease a home, house or condo. It pays to change or repair your belongings, approximately your policy limitations, must they be harmed or stolen. Furthermore, renters insurance helps pay for repair work if you christine rick mistakenly damage others' property. It likewise spends for a guest's medical expenses if you're discovered accountable for his or her injuries. And, it generally consists of extra living costs, which assists pay for expenses such as hotel bills, if your rental becomes uninhabitable due to fire or some other catastrophe.

Not known Incorrect Statements About How Does Whole Life Insurance Work

That's the national typical occupants insurance coverage expense for a policy with advised protection levels of $40,000 for individual property, with a $1,000 deductible and $100,000 of liability security, according to an Insurance. com rate analysis. But that's just one set of protection limitations. Is occupants insurance coverage pricey if you purchase more defense? No it's almost the exact same cost for more liability protection. To increase your liability limitations to the recommended amount of $300,000, costs simply a dollar more a month-- the yearly typical expense is $341, or $28 regular monthly. What you pay for tenants insurance will differ, based upon your credit history, protection quantities and where you live, to name a few factors, however is normally really affordable.

That method you'll have a concept of what renters insurance rates are for your specific scenario. You'll see it's very affordable for the coverage you get. Where you live, amongst other factors, impacts just how much you'll pay for apartment insurance coverage. You'll see in the tenants insurance calculator below the most and least expensive POSTAL CODE in your state. To get a personalized typical expense of renters insurance coverage for you, enter your POSTAL CODE and pick a personal effects, deductible and liability limitation in the renters insurance cost calculator. Read even more down if you need aid choosing how much protection you require, or describe our occupants insurance coverage guide and renters insurance coverage essentials to learn more on what tenants insurance coverage covers and how to purchase a policy.

Some states are more expensive than others when it comes to what you pay. Compared to the national average of $326 for house tenants insurance coverage, New Jersey, Tennessee and Utah have to do with average for that coverage level. Vermont and Wyoming are the least expensive, at about $160 a year. Here are average rental insurance costs by state, so you have an idea what you'll pay. Enter your state in the search field to get your results. Rates are for common coverage levels of: $20,000, $40,000 and $60,000 in personal effects coverage, with liability limitations of $100,000 and $300,000, all with a $1,000 deductible.

Nevertheless, depending upon where you live and the amount of protection you get, it might be basically. Here are monthly renters insurance estimates for common coverage levels:$ 20,000 residential or commercial property/$ 100,000 liability: $19$ 20,000 residential or commercial property/$ 300,000 liability: $21$ 40,000 home/$ 100,000 liability: $27$ 40,000 property/$ 300,000 liability: $28$ 60,000 residential or commercial property/$ 100,000 liability: $35$ 60,000 residential or commercial property/$ 300,000 liability: $37Here's how $100,000 renters insurance policies compare to $300,000 renters insurance policies. You'll see that when you increase your liability coverage, the cost for apartment insurance coverage is very little. What is cobra insurance. These occupants insurance coverage costs all have a $1,000 deductible:$ 20,000 home/$ 100,000 liability: $228$ 20,000 residential or commercial property/$ 300,000 liability: $246$ 40,000 residential or commercial property/$ 100,000 liability: $326$ 40,000 home/$ 300,000 liability: $341$ 60,000 residential or commercial property/$ 100,000 liability: $418$ 60,000 property/$ 300,000 liability: $438Here's a look at available protection that might be right for you.

How Do I Get Health Insurance Fundamentals Explained

Harris, an independent insurance agent in Los Angeles. If you are a college trainee living off school, or do not have a great deal of valuable ownerships or other assets, then you may find appropriate protection with a very bare-bones policy supplying a maximum of $12,000 to change lost, taken or damaged items. The coverage would include $100,000 for liability, which is necessary in case someone is seriously injured in your house and hits you with a claim and lawfully attempts to be reimbursed for medical costs. A minimum policy like this often has a $500 deductible and usually costs around $100 a year, possibly a little bit more or less, depending upon a few elements, consisting of where you live and your credit report.

com's rate analysis. You can also minimize the premium by $24 by raising the deductible to $1,000. But keep in mind that you may have to pay out-of-pocket for items not covered within Helpful hints the policy's limit. Note, nevertheless, that such low limitations of personal effects coverage are not advised, as the average individual has at least $35,000 worth of residential or commercial property, according to State Farm. Numerous other insurer echo this, stating a timeshare seminar normal renter with a two-bedroom apartment would have about $35,000 in individual belongings. You can constantly raise your residential or commercial property limitations later if your assets increase. You 'd also desire to increase liability coverage.